At its core, a petty cash receipt template is simply a standardized form you use to keep track of all those small, out-of-pocket business expenses that get paid from a cash fund. It’s the official paper trail for every transaction, making sure you have a record for minor purchases like office supplies, a team lunch, or reimbursing an employee for postage.

Why Petty Cash Still Matters in a Digital World

With digital wallets and instant bank transfers everywhere, keeping a physical cash box might seem a bit old-fashioned. But for countless businesses, it's still the go-to tool for handling the small, immediate expenses that keep things running smoothly.

Think about it. A contractor needs to buy a handful of screws at the local hardware store, or a cafe owner has to tip a last-minute delivery driver. In those moments, cash is often just the fastest and most practical way to get it done.

But without a system, that convenience can turn into chaos fast. We've all seen it: receipts get stuffed into wallets and forgotten, expenses go unrecorded, and the cash box never seems to balance at the end of the month. This mess leads to frustrating reimbursement delays for your team and a huge headache for whoever is trying to figure out where all the money went.

The Foundation of Financial Control

This is exactly where a simple petty cash receipt template becomes your best friend. It’s not just a piece of paper—it’s the cornerstone of financial control for your company’s smallest transactions. By making everyone record these expenses the same way, you create a clear, auditable trail for every dollar spent.

A good template forces everyone to capture the essential details every single time:

- The date and exact amount of the purchase

- A clear description of what was bought

- The name of the person who received the cash

- A signature from a manager or supervisor to confirm it was approved

Having a formal process like this gets rid of the ambiguity and guesswork. It turns a messy cash drawer into a legitimate, trackable part of your accounting system, which makes reconciling the books faster and way more accurate.

Even as payment trends change, the need for actual cash in business isn't going away. For example, the McKinsey Global Payments Report points out that while digital payments are on the rise, cash is still crucial for many day-to-day transactions. This just reinforces the need for a solid method to track where that physical money is going.

Ultimately, a petty cash receipt template brings much-needed order to the small, unavoidable expenses that fuel your daily operations.

What Every Flawless Petty Cash Receipt Needs

A solid petty cash receipt template isn't just a slip of paper—it's a critical piece of your accounting puzzle and a safeguard for your business. When you stop thinking of it as a checklist and start understanding why each field matters, your template becomes a powerful tool for financial control.

Think of it this way: each component is a layer of security for your cash fund. These details make sure every dollar spent is transparent, justifiable, and ready for review, whether it's by your own accountant or an IRS auditor.

Without a structured receipt, you're stuck with messy notes and missing details, which often lead to frustrating discrepancies that are nearly impossible to track down later. A well-designed receipt leaves no room for doubt.

The Core Components of an Airtight Receipt

Every single field on your template has a job to do. The Receipt Number, for instance, is your first defense against duplicate or fraudulent claims. By giving each transaction a unique, sequential number, you create an unbreakable chronological trail that immediately flags if someone tries to submit the same expense twice.

Then there's the Purpose of Expense field, which is absolutely non-negotiable. A lazy entry like "office supplies" just won't cut it. You need a detailed description, like "Urgent purchase of black printer ink (HP 63XL) for the marketing team's client presentation." This level of detail provides the context needed for accurate bookkeeping and keeps auditors happy. For a deeper dive into creating detailed expense records, check out our guide on the itemized receipt template.

The goal is to tell a complete story with each receipt. If someone picked it up six months from now, they should be able to understand precisely what was purchased, by whom, for what reason, and when, without needing to ask a single question.

Other fields are just as important for creating a complete financial picture. The Payee field clearly identifies who received the cash, linking the transaction to a real person. The Date locks in when the transaction happened, which is essential for closing out the books accurately each month.

Finally, signatures are about accountability. An "Approved By" signature shows that a manager gave the green light, while a "Received By" signature from the employee is their official acknowledgment of collecting the funds.

Essential Fields for Your Petty Cash Receipt Template

To make sure your team never misses a critical piece of information, here’s a quick breakdown of the fields you absolutely must include on your petty cash receipt template. Having these in place from the start will save you countless headaches.

| Field Name | Purpose | Example |

|---|---|---|

| Receipt Number | Uniquely identifies each transaction to prevent duplicates. | 00127 |

| Date | Records the exact date the transaction occurred. | 2024-10-26 |

| Payee | Name of the person receiving the cash for the expense. | Sarah Jenkins |

| Amount (Numerical) | The total expense amount written in numbers for quick reference. | $24.50 |

| Amount (Written) | The total expense written out in words to prevent alteration. | Twenty-four dollars and fifty cents |

| Purpose of Expense | A detailed description of what was purchased and why. | "Postage for sending client contracts via express mail" |

| Approved By | Signature of the manager or custodian who authorized it. | J. Smith |

| Received By | Signature of the employee who received the cash. | S. Jenkins |

Making these fields mandatory ensures every slip is a complete, auditable record. It’s a simple step that reinforces good financial habits across your entire organization.

While a basic downloadable form can work in a pinch, creating a custom petty cash receipt template for your business is a total game-changer. It’s not just about looking more professional; it's about building a reimbursement process that actually fits how your company operates. Using a tool like ReceiptGen lets you ditch the generic layouts and design a polished, branded document in minutes.

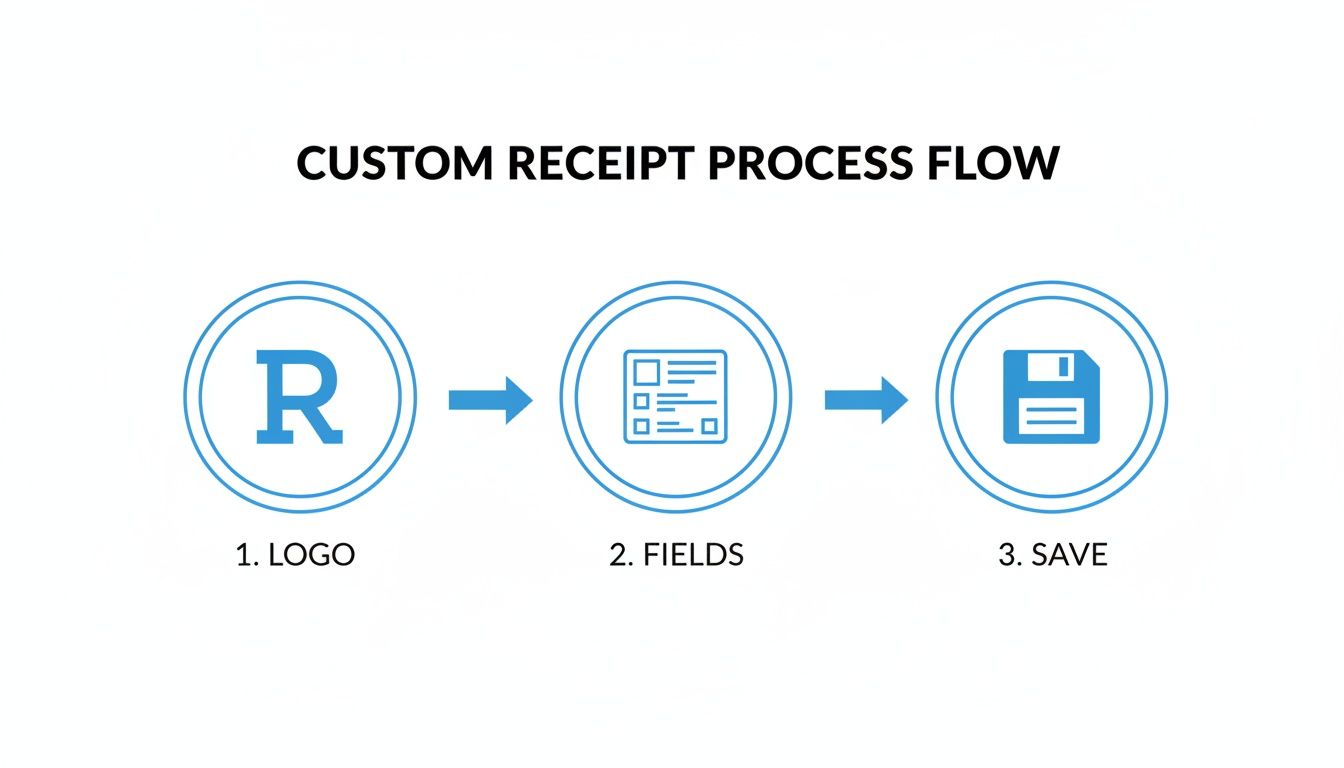

The whole process kicks off by picking a base design. Don't think of it as a rigid structure—it's more like a starting point. From there, you get total control to add, remove, and rename fields until it perfectly matches how your team handles small expenses.

Adding Your Professional Touch

First things first, let's make the template yours by adding your company's branding. Simply uploading your logo is a small move that has a big impact, reinforcing your brand's identity on every internal document. This little detail adds a layer of professionalism and makes your forms feel like a cohesive part of your company's official materials.

Here’s a peek at the intuitive interface you’ll be working with in ReceiptGen.

As you can see, the editor gives you a clean, live preview. You see every change instantly as you customize your template.

This visual approach takes all the guesswork out of the equation. You can play around with different layouts and fields without committing, making sure the final version is exactly what you had in mind. The real goal here is to build a template that’s not just functional, but also visually clear and easy for any employee to fill out correctly.

Customizing Fields for Better Accountability

This is where you can really make your petty cash receipt work for you. Instead of being stuck with generic labels, you can add custom fields that are absolutely essential for your specific workflow.

For instance, you might want to add:

- An "Approved By" Line: A dedicated signature line for the supervising manager.

- A "Custodian Signature" Field: A space for the petty cash custodian to sign off, confirming they handed out the funds.

- A "Department" Dropdown: A pre-filled list (Marketing, Sales, Operations, etc.) to make cost allocation a breeze.

You could also pre-populate common expense categories. If your team is constantly buying "Office Supplies" or covering "Client Refreshments," adding these as standard options saves everyone time and keeps the data entry consistent. That consistency is gold for your accounting team come reconciliation time.

The key is to think about the entire lifecycle of a petty cash request. By customizing your template, you’re not just creating a form; you’re designing a smoother, more accountable workflow from start to finish.

As you build out your custom receipt, think about how you can create PDF forms that automate your workflow. This mindset helps turn a simple document into a dynamic part of your financial management system, cutting down on manual entry and the errors that often come with it.

Saving Your Master Template for Future Use

Once you’ve got the design just right, the final step is saving it as your master template. This is probably the most critical feature for maintaining long-term consistency. When you save your custom design, you’re creating a single source of truth for all petty cash reimbursements company-wide.

From that point on, anytime an employee needs to submit an expense, they can generate a fresh receipt from your master version. This guarantees that every single request follows the same professional format, includes all the necessary fields, and carries your company branding. You can explore our full range of options by checking out the various receipt templates we have available.

This one simple action gets rid of the risk of outdated or inconsistent forms floating around, making your entire petty cash process more reliable and a whole lot more efficient.

Implementing a Bulletproof Petty Cash Process

A sharp-looking petty cash receipt template is a fantastic starting point, but let’s be honest—it’s just one part of the equation. The real magic happens when you build a rock-solid process around it. A well-defined system is what turns that simple form into a powerful tool for preventing cash leaks, speeding up reimbursements, and keeping your financial records airtight.

Without clear rules, even the most perfect template will fall short. Your process needs to eliminate any gray areas, so every employee knows exactly what to do and every dollar is tracked from the cash box to the final accounting ledger.

This flowchart breaks down a simple, repeatable process for generating consistent receipts from your master template.

By standardizing things like your logo and required fields, you guarantee every receipt that comes through is professional and contains all the necessary information.

Setting Up Your Fund and Guidelines

First things first, you need to decide on the right "float" for your cash box. This is the fixed amount of cash you'll start with. A small office might get by just fine with $100, whereas a bustling retail shop could easily need $500. A good rule of thumb is to look at the last month's small cash expenses to find a comfortable number—enough to keep you from running to the bank every few days, but not so much that it becomes a security concern.

Next, you have to draw a clear line in the sand about what petty cash can be used for. Get specific here.

- Good to go: Office supplies under $50, grabbing coffee for a client, postage, or emergency cleaning supplies.

- Not allowed: Personal purchases, employee lunches (unless it's a pre-approved team event), or larger expenses that really should be handled through a proper invoice.

Putting these rules in writing and making sure everyone on the team has seen them is key. It cuts down on confusion and gives the person managing the cash the confidence to approve or deny requests based on company policy, not guesswork.

The Reconciliation and Security Protocol

Balancing the box, or reconciliation, is hands-down the most important piece of this puzzle. You need to do it regularly—I recommend weekly for funds that see a lot of action, and at least monthly for quieter ones. The math is straightforward: your starting float should always match the cash left in the box plus the total of all your receipts.

Starting Float = Cash on Hand + Total of Receipts

If those numbers don't add up, you've got a problem that needs to be sorted out right away. Finding small mistakes early stops them from spiraling into bigger headaches later on.

Security is equally important. Appoint one trustworthy person as the petty cash custodian. This individual is the gatekeeper, in charge of handing out cash, collecting receipts, and balancing the box. Having a single point person creates clear ownership and dramatically lowers the risk of mistakes or misuse. And it goes without saying: always keep the cash box locked up somewhere safe.

To really nail down your accuracy and speed up bookkeeping, think about using tools that can extract invoice data from PDF files. When you can automate data entry from scanned receipts, you cut down on human error and make the entire reconciliation process quicker and more reliable. It’s the final step that ensures your records are as clean as your process.

Avoiding Common Petty Cash Management Pitfalls

Even with the perfect petty cash receipt template, things can still go sideways. Ask any office manager, and they'll have a story about the cash box not balancing or a reimbursement request that raises eyebrows. The key to a smooth system is knowing these common issues and tackling them head-on with clear, practical solutions.

Most headaches I see come from just a few recurring scenarios: employees losing the original receipt, submitting vague expense descriptions, or the fund constantly running on empty. Luckily, there's a simple fix for each of these common pitfalls.

The Mystery of the Missing Receipt

It happens. An employee makes a totally legitimate purchase but loses the vendor receipt somewhere between the store and their desk. This puts you in a tough spot—do you reimburse them without proof, or stick to the rules and cause frustration? My advice? Establish a firm but fair policy from the very beginning.

A "no receipt, no reimbursement" rule might seem harsh, but it's the single most effective way to protect your financial records. Forgetting a receipt once is an honest mistake, but if it becomes a habit, it can point to bigger problems. This policy leaves no room for gray areas and underscores how critical documentation is for every single transaction.

A strong policy isn't about punishing employees; it's about protecting the business. It ensures every expense is verifiable, which is non-negotiable for accurate bookkeeping and tax compliance.

Conquering Vague Expense Descriptions

Another classic issue is getting receipts with lazy or unhelpful descriptions. An entry for "miscellaneous" or "supplies" is an accountant's worst nightmare because it offers zero context and makes it impossible to allocate costs correctly.

The best way to solve this is with a little hands-on training. Take five minutes in a team meeting to walk everyone through how to fill out the petty cash slip properly. Show them exactly what a good description looks like.

- Instead of: "Office Supplies"

- Try: "Black printer ink (HP 63XL) for marketing department printer"

- Instead of: "Client meeting"

- Try: "Coffee and pastries for meeting with ACME Corp team"

This quick coaching session sets clear expectations and guarantees you get the detailed info you need for accurate financial tracking.

When the Cash Box Is Always Empty

Do you find your petty cash fund is always drained days before it's due for a top-up? This is a huge red flag. It usually means one of two things: your initial float—the starting amount in the box—is too low for your company's actual needs, or people are using it for purchases that should go through other channels.

Make a habit of reviewing your petty cash usage. If you're seeing a consistent, legitimate need for more cash on hand, it's time to increase the float. On the other hand, if you spot purchases that exceed the petty cash limit, it's a perfect opportunity to gently reiterate the rules and redirect those larger expenses to the proper accounts payable process. A well-managed fund should never cause a last-minute panic.

Common Questions About Petty Cash

When you're managing a petty cash fund, a few questions always seem to pop up. Getting the process right from the start saves a lot of headaches later, ensuring everything is tracked, compliant, and easy for your team to follow.

Let's clear up some of the most common points of confusion.

What’s the Difference Between a Petty Cash Voucher and a Receipt?

This is a great question, and I see people mix these up all the time. The difference is actually pretty straightforward and crucial for keeping your fund secure.

Think of a petty cash voucher as the internal permission slip. It’s the form an employee fills out before a purchase to get approval to take money from the cash box. It says, "I need X amount for Y reason."

A petty cash receipt, on the other hand, is the form filled out after the money has been spent. This is the official record of the transaction, and it's always paired with the original vendor receipt. The voucher authorizes the spending, while the receipt proves it happened.

How Often Should I Reconcile My Petty Cash Fund?

The best answer here really depends on how often the cash box is being used.

If you’re in a busy office with people dipping into petty cash daily, a weekly reconciliation is a must. It helps you catch any mistakes or missing funds right away before they become a bigger problem.

For a smaller business where the fund is only used occasionally, a monthly check-in is probably fine.

The golden rule, no matter what, is to always reconcile the fund before you replenish it. This is non-negotiable. It ensures you know exactly where every dollar went before you add more cash to the box, maintaining the integrity of the whole system.

Can I Use a Digital Petty Cash Receipt Template?

Yes, you absolutely should! Moving to a digital petty cash receipt template is one of the best upgrades you can make to your process. Using a tool like ReceiptGen makes everything cleaner and more efficient.

Digital forms ensure every submission is consistent, professional, and easy to read—no more deciphering messy handwriting. Employees can fill out and submit their forms from anywhere, creating a perfect PDF record. This gets rid of lost paper slips and makes life so much easier for your accounting team when it's time to close the books or prepare for taxes.

If you're still using spreadsheets, you can learn more about creating a petty cash receipt template in Excel to get started.

Ready to create flawless, professional receipts in seconds? With ReceiptGen, you can design a fully custom petty cash receipt template that fits your exact needs. Try our free receipt maker today!